Step 1: Tour the homes on your short list.

Ask

your discount broker or agent to show you inside

five or six of your top choices. Do this

even if you have your heart set on just one of

them--looking at several alternatives will help

you decide how much to offer and may improve

your bargaining position.

Step 2: Try to

find problems with your top

picks.

Before making

an offer, make sure there's nothing seriously

wrong with the property.

Ask your broker for the following:

-

The disclosure packet (if available).

This will usually be emailed to you as a pdf

file.

-

All previous MLS listings of each property,

with photos. This will tell you, for

example, how much the current owner paid for

it and what upgrades have been made.

Then do the following:

-

Talk to neighbors.

-

In California, visit the

Megan's Law website to see if any

registered sex offenders live nearby

-

If you're buying land, go to the county

planner and discuss zoning restrictions on

the parcel.

-

Call an insurance company to verify that the

home is insurable.

-

If the home is in a risky area, ask

the seller for a

C.L.U.E. (Comprehensive Loss

Underwriting Exchange) report for the

house. This lists all insurance claims that

have been made on the house for the past

five years.

-

If the home is governed by a homeowners

association (HOA), ask about monthly fees

and

CC&Rs. If you're buying a condo or

cooperative unit, ask to see the

association's legal and financial

documents.

-

If you like, you can download

parcel maps and other deed information. In

many western states, you can find a treasure

trove of information at

netronline.com for $3 each. Another

website,

docedge.com, charges $5 per map but

covers a broader area.

|

Before making an offer on a

house, I like to stroll through the

neighborhood. I invariably find one

or two neighbors outside doing

gardening or unloading groceries.

They almost always give me useful

information. |

Step 3: Estimate the home's market value

If you still want to go ahead with an offer,

you'll need to come up with an offer price.

Start by estimating the home's market value.

To estimate the home's market value, I recommend

that you collect data from various sources:

-

Ask your broker for a comparative market

analysis of the property, showing the prices

paid for properties that have recently sold,

and asking prices for active, withdrawn, and

cancelled listings. Drive by these

properties and look for the best deals.

-

Get a $29.95 Complete Property Valuation

from

electronicappraiser.com.

-

Get free online appraisals of the property

from

Zillow.com,

realestateabc.com, and

Ditech.com.

(On the Ditech website, click on

"Calculators," and then click on "Free

eAppraisal.") These websites don't reveal

their appraisal methodology, but I think

it's based on taking the last sales price

for the property and scaling it upward or

downward according to how average property

prices in the neighborhood have changed. If

the owner has spent a lot of money

remodeling the house, you should fudge the

estimates up accordingly. I found that

Zillow gave fairly good estimates for houses

in subdivisions but poor estimates for

houses with unique attributes, like

custom-built homes on scenic lots. Zillow

allows you to review the details they have

about your home (Click on the "See home

details" link) and edit them.

-

Get information about "comparables"--houses

that are similar to the one you want to buy

that have sold recently.

Zillow.com

and

realestateabc.com are good sources.

(Click the "Map comparable homes" link.) So

is

realestate.yahoo.com (Click on What's My

Home Worth? in the Tools section on the left

hand side.) Create a separate fact sheet

for each comparable, then

drive (or better yet, walk) by all of the

homes and compare them to the one you want.

Try to guess how much more or less your

dream house is worth compared to each of

them, then use these guesses to fudge the

actual sales prices of the comparables into

estimates of your home's market value.

|

Don't

rely too much on online appraisals.

Here are the estimates I got from

some online appraisal services for

four different properties in

California:

A

custom house in the city, last sold

in 1998:

-

Zillow.com: $990,120

-

RealestateABC.com: $958,000

-

Ditech.com: $793,000-$975,000

A

custom house with scenic view on the

coast, last sold in 2002:

-

Zillow.com: $467,007

-

RealestateABC.com: Insufficient

data

-

Ditech.com: $562,000 - $727,000

A

tract home, last sold in 1983:

-

Zillow.com: $492,520

-

RealestateABC.com: $490,000

-

Ditech.com: $515,000 - $595,000

A

tract home, last sold in 2005:

-

Zillow.com: $405,040

-

RealestateABC: $432,000

-

Ditech.com: $405,000 - $498,000

|

|

Other sources won't be of much help,

either. I examined three reports by

certified appraisers that were based

on adjusting the sales prices of

comparables that had sold recently

to account for differences between

them and the subject property. The

adjusted sales prices often varied

by quite a bit:

|

Property

|

Adjusted sales

prices

of comparables |

Appraised value

|

|

#1 |

$717,500

$671,500

$720,000 |

$700,000 |

|

#2 |

$138,500

$148,175

$148,955 |

$148,000 |

|

#3 |

$476,180

$507,380

$541,150 |

$475,000* |

|

*This property had just

sold for $475,000 and

the purpose of the

appraisal was to

reassure the lender that

the price was

reasonable. |

|

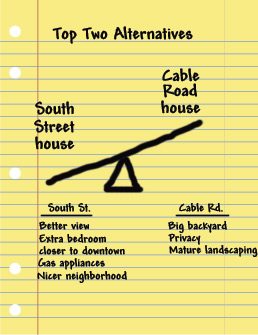

Step 4: Figure out what you think the

home's worth

This value may be more or less than the home's

market value, but bear in mind that lenders

sometimes won't approve loans if the sales price

is much higher than the appraised market value.

A good way to figure out what the home is worth

to you is to weigh your alternatives against one

another. Suppose you're interested in a house

on South Street, but you also like a smaller one

on Cable Road. Write down the benefits of the

two choices on a piece of paper. Here's how

your notes might look:

This diagram shows that, to you, the benefits of

the South Street house outweigh those of the

Cable Road house.

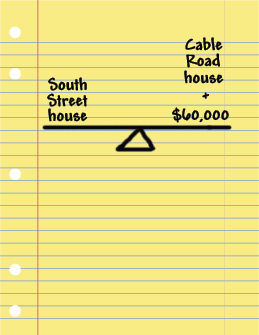

Now try to imagine how much money you would need

to add to the Cable Road house in order to make

the two properties equally appealing to you.

For example, if you added $100,000 to the Cable

Road house, would that make it more appealing to

you than the South Street house? Keep testing

different numbers until you come up with a

number that exactly balances the two sides, like

this:

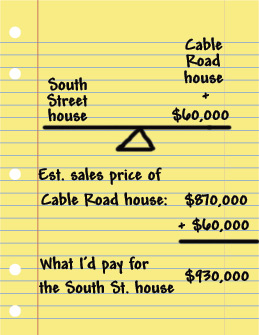

Now guess the market value of the Cable Road

house (say $870,000) and do some algebra. Think

of the balance's fulcrum as an equal sign and

solve for the value of the South Street house.

In this case, the equation would read: South

Street house = Cable Road house + $60,000.

Substituting in your estimate of the price of

the Cable Road house, you'll get a value for the

South Street house of $870,000 + $60,000 =

$930,000.

The sum, $930,000, gives you an estimate of the

maximum price you should pay for the South

Street house, based on the assumption that you

could buy the Cable Road house for $870,000.

Do

the same exercise with your other options.

|

When deciding how much a house is

worth to you, consider renting as an

option.

See

The Buy vs. Rent Decision by

Suze Orman for

help in thinking this through. |

Step 5:

Consider your bargaining position

My husband is a good negotiator, but it's

agonizing to watch him in action. He sometimes

starts low--really low. The buyer's agent (or

car salesperson) invariably looks crestfallen.

I don't say anything during these negotiations,

but I always feel ashamed and

embarrassed. After wasting hours or even days

of the salesperson's time, we're finally

revealing ourselves to be flaky and unrealistic.

But we often end up getting terrific deals.

|

Buyers' agents will often act

disappointed or annoyed if you want

to make a low offer. Pay no

attention. |

Of course, we don't always make low offers.

Once, we even made a full-price offer with no

contingencies on a lot that we absolutely had to

have. There were no other lots like it and we

were afraid we'd lose it to another buyer.

Whether or not you can start low depends on the

strength of your bargaining position. Here are

some factors that would give you a strong

bargaining position:

-

If the house has been on the market for a

long time.

-

If there are other, similar houses in the

neighborhood.

-

If you're likely to be able to close the

deal in a timely manner.

-

If you're interested in more than one house.

-

If you're in no hurry to buy a house.

If your bargaining position is weak, it will be

harder to get a good deal. That's why it's a

good idea to strengthen your position before you

begin negotiations. One way to do this is to

sell your existing home before you begin

searching for a replacement. Another is to go a

mortgage lender and get pre-approved for a loan

so you can demonstrate your ability to buy the

house. Finally, you should look at lots of

houses and try to find several that are

acceptable to you.

Step 5:

Decide on an offer price

Sellers usually set their asking price about

1-10% above their estimate of its market value.

But sellers can get that wrong, and they're

sometimes willing to accept offers that are well

below the asking price.

If your bargaining position is very strong, try

subtracting 10% from either your estimate of the

market value or the asking price--whichever is

lower. Suppose, for example, the asking price

was $950,000 and your estimate of the home's

market value was $920,000. I'd recommend that

you consider a starting offer of $830,000 (which

is roughly 90% of $920,000). Before making this

offer, verify that the offer falls below your

lowest estimate of what the house is worth to

you ($910,000 in our example). If it doesn't,

lower it.

If your bargaining position is weak, or if the

housing market is hot in your area, you'll

probably want to make an offer that's much

closer to the asking price. And if the market

is very hot, you may want to make an offer

that's above the asking price.

Next step:

Making an offer.

ŠLori Alden, 2008. All rights reserved.

|